Have you ever felt as if someone was watching you while working in your operatory? I know I have. And it’s because there are always people watching you. No, they are not in the operatory with you, but they might as well be. They are the ever-present representatives of your insurance company.

Every time you bill an insurance company, they keep track. The insurance company representatives are responsible for logging the procedure in their computers. They use this data to analyze you, and, just as importantly, they analyze the other dentists in your area. They compare the number of your procedures you complete to that of your neighboring dentists. They use spreadsheets, databases and algorithms — all to crunch the numbers to see what you've been up to.

The insurance companies do what practice consultants say we should be doing in our own offices. Yes, we should be statistically analyzing the procedures we perform. It would also be great if we could analyze our neighboring competitors. However, it is the insurance companies who have the budgets and staff to do this — not us — so they are, in fact, doing this. And not only are they analyzing your practice, they also want to tell you how to run your practice and treat your patients. No, they don't say it outright; they code their language. They are only here to “advise” you. However, should you not listen to their advice, there will be consequences.

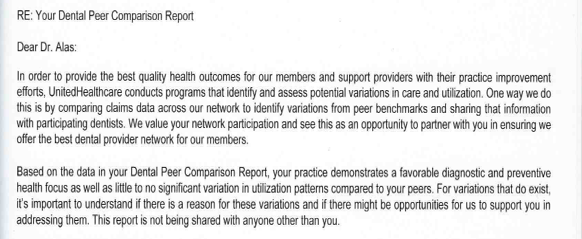

Here is an example of a letter I received. (I have received similar letters concerning prescribing patterns, crown buildup patterns, surgical extraction, etc.)

The first sentence reads, in part, “...support providers with their practice improvement efforts.” Of course, the insurance company only is doing this to “help” you. Notice how this report assumes your practice needs improvement. What if your practice is firing on all cylinders, and that is why you are doing so much better than your colleagues?

In the second paragraph, they write, “...there might be opportunities for us to support you...” How kind of them to take time out of their busy schedules to support me.

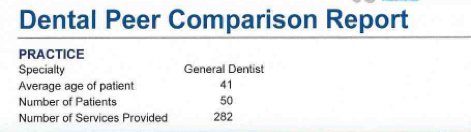

Next, at the beginning of the next page, I noticed this:

I have to admit, I did not know the average patient in my office utilizing this insurance plan is 41 years old. How would anyone know that unless they were analyzing my practice? I admit this is the kind of statistical information I should be tracking. But who has the time? Your friendly insurance company, that's who.

So what should you do when you receive one of these letters? My recommendation is to shred it. Yep, toss it.

As a profession, we have to decide who's in charge of our patients’ care. If the answer is the dentist (and everyone keeps telling us it is) then we will decide how many crown buildups, extractions, prescriptions, etc., are warranted. As soon as we give up this decision-making, we become employees of the insurance companies.

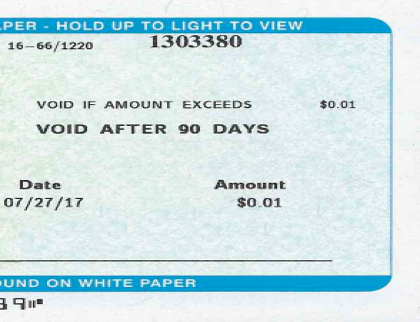

But, don't worry, after a long day of taking care of patients and dealing with insurance companies, your efforts will be well rewarded:

Leave a comment