Dentists Should Prepare for the Worst with Disability Insurance

Dentists develop expertise in caring for patients but may not recognize the importance of protecting themselves in case they become disabled. For peace of mind and a financial cushion, it’s wise for dentists to have disability insurance.

According to the Social Security Administration, 1 in 4 20-year-old workers will become disabled for at least one year before reaching retirement age.1 Similarly, dentists have a 1 in 4 chance of becoming disabled.2

“Dentists call me from all over the world for advice. They have training and education and, suddenly, they can’t work as a dentist anymore,” said Ronald J. Marsh, DDS, president of the American Association of Disabled Dentists (AADD). The AADD provides free resources to disabled dentists, such as information on filing for disability and pursuing alternative careers.

TYPES OF DISABILITIES

Lorin F. Berland, DDS, began drawing disability after injuries affected him (see “A Disabled Dentist Finds a New Career”). “With a dentist, it’s not just your hands,” said Berland. “You need perfect 3D and color vision. Your neck, back and hands are involved. Your legs are working the foot pedals. From the top of your body down to your toes, you are a working machine.”

Insurance specialists say disability is intended to cover 60% of salary.3 Under individual disability insurance coverage, dentists who become disabled through illness or injury typically receive benefit payments through age 65. However, other options are two, five or 10 years, or to age 67, depending on the plan. Benefits typically max out at $15,000 or $20,000 per month.

“The majority of claims are for illnesses,” said Rhett Stubbendeck, disability insurance agent at LeverageRx, a personal finance and insurance company for healthcare professionals.

Long-term disabilities are reportedly often due to musculoskeletal disorders (27.6%), neoplasms (15%), mental disorders (9.3%), cardiovascular diseases (8.2%) and other ailments.3 Dentists may suffer from a variety of illnesses, including arthritis, neurological issues and vision problems. Orthopedic issues are common — lumbar, lower back, cervical, shoulder, carpal tunnel.

“A lot is related to repetitive use. Dentists are leaning forward, arms extended, and holding that position for long periods of time. It is an unnatural position. They can have a lot of issues that surgery can’t necessarily solve because they go back to doing the same thing,” said Art Fries, a California-based disability claims consultant whose main clients are dentists. He added that a medical condition does not determine the disability benefits at claim time, but it does determine what the insurance company will cover from the beginning.

DISABILITY INSURANCE COMPANIES AND BROKERS

When looking for disability insurance, it’s advantageous for a dentist to seek an experienced broker who offers various individual plans. Brokers, who are paid a commission, tend to offer coverage from multiple highly rated companies, such as Guardian, MassMutual, The Standard, Principal and Ameritas.

“A broker who is experienced in this area knows what to do. One company may not cover your lower back and your hands, and another company may cover these after a one-year waiting period. Ask around, and find someone who knows disability,” Fries said.

“You’ll get a better and more personalized approach by using a local broker agency. Work with one for a few years, get to know one,” said Richard C. Engar, DDS, FAGD, former AGD Impact Risk Management columnist and retired CEO and senior consultant at Professional Insurance Exchange Mutual Inc., a member-owned mutual insurance company based in Salt Lake City that offers disability, property and malpractice insurance to Utah dentists.

Another option is to seek a brokerage firm such as PolicyGenius or LeverageRx, which sell disability policies nationwide. “A dentist in any state could get a policy through LeverageRx. We are located in Omaha, Nebraska, but are all online,” said Stubbendeck.

TOP POLICY FEATURES TO SEEK

Specialists in the field recommend choosing key features in disability insurance plans and adding riders for greater protection. “‘Own-occupation’ is No. 1 in importance, hands down,” Stubbendeck said.

An own-occupation policy or rider means a dentist who can no longer perform in his or her medical specialty due to disability will receive benefits. Typically, a dentist can still earn income in another career. “Guaranteed coverage” means coverage applies to age 65. “Noncancelable” means the insurance company cannot cancel or change the policy or raise premiums.

Under a “future increase” rider, dentists can purchase more insurance if their income increases or they are no longer covered by a group policy without undergoing future medical exams or medical underwriting. Dentists may need to show proof of income and provide a tax return.

“As you make more money, use the insurability option to buy more as you can get more, and hope you never need it,” said Fries.

Under the “partial disability” rider, the policy pays out if a dentist has a 15%–20% loss of income. “I’ve seen everything from nerve damage to breathing issues. If you can’t feel your hands, you are opening yourself up to other issues when doing dental procedures,” said Stubbendeck.

Cost of living adjustment and student loan repayment riders bump up premium costs and offer added disability benefits.

TIMING AND COST OF COVERAGE

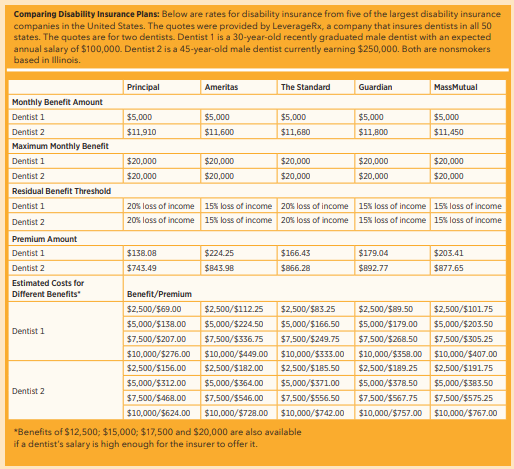

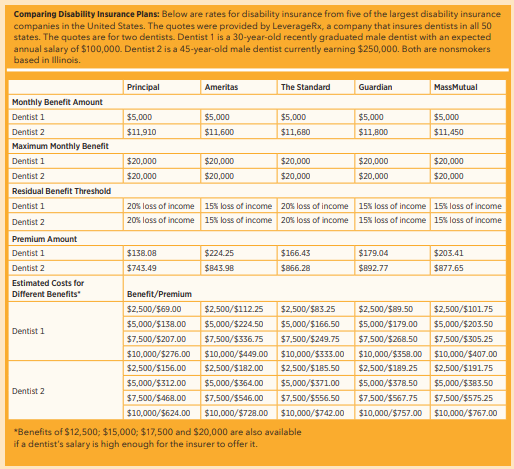

Experts recommend buying disability insurance as early as possible. A 30-year-old healthy dental school student will have lower premiums than a 45-year-old practicing dentist who has never had coverage (see “Comparing Disability Insurance Plans”).

“You get better coverage the younger you are. Even though you come out of dental school heavily in debt, it is still best to get disability insurance early on,” said Engar.

Disability insurance premiums tend to cost 1%–3% of a salary, depending on age, gender, health, occupation, benefit amount and location.

It’s preferable to purchase disability insurance while residing in a less expensive U.S. state — either where one attends dental school or where one plans to move to practice dentistry. “This comes down to the noncancelable clause — an insurance company can’t change the terms of your policy until you turn age 65,” said Stubbendeck.

A dentist may want to consult with his or her broker and accountant for advice, but it’s often advantageous to pay for disability insurance premiums with post-tax dollars.

“Don’t write off your premium as a business expense. If you are doing so, stop. If you pay for disability insurance with before-tax dollars, your disability income is taxable income. If you pay for it with after-tax dollars, it is tax-free,” said Berland.

GROUP PLANS AND LAYERING POLICIES

Dentists have the option of selecting an American Dental Association (ADA) policy administered by Great-West Financial. The plan is offered to ADA members at discounted rates and pays disability benefits to age 67. Dentists can apply for up to the maximum benefit of $15,000 per month but may qualify for less, as benefits are based on income.

“The ADA policy is an association policy where there isn’t a group plan. You could be based anywhere in the country and get it. Group plans can change the rate and change the wording. A lot of individual plans guarantee the wording,” said Fries.

A dentist could be covered by an ADA policy, a group policy and more than one individual policy. Group plans are offered by corporate dental practices. Individual carriers may have a maximum monthly benefit a dentist can quality for if he or she has multiple policies. Disability benefits are generally capped at a maximum total benefit amount, regardless of whether a dentist enrolls in one plan or many plans.

FILING FOR DISABILITY AND RELATED ISSUES

Disability insurance will begin paying benefits after a waiting period, which is generally 30, 60 or 90 days from the date of accident or illness. Premiums tend to be waived after a dentist begins collecting benefits.

“The sooner you identify a disability, the sooner you can file. A lot depends on the severity of the injury. But it is common for people to be in denial. It is not set in stone, but you often need to file within 90 days. You usually can’t start collecting until 30 days after you file,” said Marsh.

Engar recommends dentists keep a liquid emergency fund that can cover several months of expenses before disability benefits kick in.

Dentists may want to maintain licenses and certifications, as it can be hard to reinstate them if they lapse. But they also need an emergency plan for their dental practice, preferably in writing. Optional overhead insurance is typically paid out for only one year if a dentist is disabled. Perhaps the affected dentist’s peers can fill in for a few months while the practice is readied for sale, if necessary.

Disabled dentists who wish to pursue new careers may find satisfaction in teledentistry, dental practice consulting, dental claims processing, law, real estate or other fields. These alternatives may involve retraining or additional schooling.

“There are so many jobs out there related to healthcare where you can feel appreciated. Maybe you have leukemia, are breathing badly or have back pain and cannot make a living in clinical dentistry anymore. You can generally collect disability while working in another career. That is the norm now, but be sure that when you read the policy, you understand it,” said Marsh.

RESOURCES FOR DISABLED DENTISTS

Becoming disabled can necessitate financial adjustments for a dentist. “If you have to take disability payments, you are not going to get rich off of it. You will have to be more frugal,” said Engar.

Aside from financial concerns, dealing with a disability can be physically challenging and emotionally draining. “Take care of your injury first. Get proper medical care. You have to be able to survive. It was two years before I felt close to normal. Plan A is to get better,” said Marsh.

It can be difficult to come to terms with no longer being able to practice as a dentist in the career you trained for. Marsh’s left arm and leg were injured to the point where he couldn’t work. “Obviously, I couldn’t do dentistry anymore. But I could still be productive. I teach at a local dental hygiene school, am on the state dental board and am running AADD,” he said.

Marsh recommends reaching out to family, friends and fellow dentists for help. Churches may be good resources, as can support groups for cancer, cardiac issues and other ailments. Marsh says disability can bring anxiety and depression, so find supportive people and look to nature for peace and strength.

“If you are not going to get better, you have to have a Plan B and a Plan C,” Marsh said. “Take a deep breath. Look outside; the sun is shining. Start making some plans.”

Sarah Louise Klose is a freelance writer based in Chicago. To comment on this article, email impact@agd.org.

REFERENCES

1. Maleh, Johanna, and Tiffany Bosley. “Disability and Death Probability Tables for Insured Workers Born in 2000,” Social Security Administration, Actuarial Note, No. 2020. 6, June 2020.

2. Great-West Financial. “Disability Income Protection and Office Overhead Expense,” American Dental Association, insurance.ada.org/disability-insurance.aspx. Accessed 1 Aug. 2021.

3. “Health and Disability Benchmarking 2019, Long-Term Disability Program,” Integrated Benefits Institute, 2019, released 10 Sept. 2020.

According to the Social Security Administration, 1 in 4 20-year-old workers will become disabled for at least one year before reaching retirement age.1 Similarly, dentists have a 1 in 4 chance of becoming disabled.2

“Dentists call me from all over the world for advice. They have training and education and, suddenly, they can’t work as a dentist anymore,” said Ronald J. Marsh, DDS, president of the American Association of Disabled Dentists (AADD). The AADD provides free resources to disabled dentists, such as information on filing for disability and pursuing alternative careers.

TYPES OF DISABILITIES

Lorin F. Berland, DDS, began drawing disability after injuries affected him (see “A Disabled Dentist Finds a New Career”). “With a dentist, it’s not just your hands,” said Berland. “You need perfect 3D and color vision. Your neck, back and hands are involved. Your legs are working the foot pedals. From the top of your body down to your toes, you are a working machine.”

Insurance specialists say disability is intended to cover 60% of salary.3 Under individual disability insurance coverage, dentists who become disabled through illness or injury typically receive benefit payments through age 65. However, other options are two, five or 10 years, or to age 67, depending on the plan. Benefits typically max out at $15,000 or $20,000 per month.

“The majority of claims are for illnesses,” said Rhett Stubbendeck, disability insurance agent at LeverageRx, a personal finance and insurance company for healthcare professionals.

Long-term disabilities are reportedly often due to musculoskeletal disorders (27.6%), neoplasms (15%), mental disorders (9.3%), cardiovascular diseases (8.2%) and other ailments.3 Dentists may suffer from a variety of illnesses, including arthritis, neurological issues and vision problems. Orthopedic issues are common — lumbar, lower back, cervical, shoulder, carpal tunnel.

“A lot is related to repetitive use. Dentists are leaning forward, arms extended, and holding that position for long periods of time. It is an unnatural position. They can have a lot of issues that surgery can’t necessarily solve because they go back to doing the same thing,” said Art Fries, a California-based disability claims consultant whose main clients are dentists. He added that a medical condition does not determine the disability benefits at claim time, but it does determine what the insurance company will cover from the beginning.

DISABILITY INSURANCE COMPANIES AND BROKERS

When looking for disability insurance, it’s advantageous for a dentist to seek an experienced broker who offers various individual plans. Brokers, who are paid a commission, tend to offer coverage from multiple highly rated companies, such as Guardian, MassMutual, The Standard, Principal and Ameritas.

“A broker who is experienced in this area knows what to do. One company may not cover your lower back and your hands, and another company may cover these after a one-year waiting period. Ask around, and find someone who knows disability,” Fries said.

“You’ll get a better and more personalized approach by using a local broker agency. Work with one for a few years, get to know one,” said Richard C. Engar, DDS, FAGD, former AGD Impact Risk Management columnist and retired CEO and senior consultant at Professional Insurance Exchange Mutual Inc., a member-owned mutual insurance company based in Salt Lake City that offers disability, property and malpractice insurance to Utah dentists.

Another option is to seek a brokerage firm such as PolicyGenius or LeverageRx, which sell disability policies nationwide. “A dentist in any state could get a policy through LeverageRx. We are located in Omaha, Nebraska, but are all online,” said Stubbendeck.

TOP POLICY FEATURES TO SEEK

Specialists in the field recommend choosing key features in disability insurance plans and adding riders for greater protection. “‘Own-occupation’ is No. 1 in importance, hands down,” Stubbendeck said.

An own-occupation policy or rider means a dentist who can no longer perform in his or her medical specialty due to disability will receive benefits. Typically, a dentist can still earn income in another career. “Guaranteed coverage” means coverage applies to age 65. “Noncancelable” means the insurance company cannot cancel or change the policy or raise premiums.

Under a “future increase” rider, dentists can purchase more insurance if their income increases or they are no longer covered by a group policy without undergoing future medical exams or medical underwriting. Dentists may need to show proof of income and provide a tax return.

“As you make more money, use the insurability option to buy more as you can get more, and hope you never need it,” said Fries.

Under the “partial disability” rider, the policy pays out if a dentist has a 15%–20% loss of income. “I’ve seen everything from nerve damage to breathing issues. If you can’t feel your hands, you are opening yourself up to other issues when doing dental procedures,” said Stubbendeck.

Cost of living adjustment and student loan repayment riders bump up premium costs and offer added disability benefits.

TIMING AND COST OF COVERAGE

Experts recommend buying disability insurance as early as possible. A 30-year-old healthy dental school student will have lower premiums than a 45-year-old practicing dentist who has never had coverage (see “Comparing Disability Insurance Plans”).

“You get better coverage the younger you are. Even though you come out of dental school heavily in debt, it is still best to get disability insurance early on,” said Engar.

Disability insurance premiums tend to cost 1%–3% of a salary, depending on age, gender, health, occupation, benefit amount and location.

It’s preferable to purchase disability insurance while residing in a less expensive U.S. state — either where one attends dental school or where one plans to move to practice dentistry. “This comes down to the noncancelable clause — an insurance company can’t change the terms of your policy until you turn age 65,” said Stubbendeck.

A dentist may want to consult with his or her broker and accountant for advice, but it’s often advantageous to pay for disability insurance premiums with post-tax dollars.

“Don’t write off your premium as a business expense. If you are doing so, stop. If you pay for disability insurance with before-tax dollars, your disability income is taxable income. If you pay for it with after-tax dollars, it is tax-free,” said Berland.

GROUP PLANS AND LAYERING POLICIES

Dentists have the option of selecting an American Dental Association (ADA) policy administered by Great-West Financial. The plan is offered to ADA members at discounted rates and pays disability benefits to age 67. Dentists can apply for up to the maximum benefit of $15,000 per month but may qualify for less, as benefits are based on income.

“The ADA policy is an association policy where there isn’t a group plan. You could be based anywhere in the country and get it. Group plans can change the rate and change the wording. A lot of individual plans guarantee the wording,” said Fries.

A dentist could be covered by an ADA policy, a group policy and more than one individual policy. Group plans are offered by corporate dental practices. Individual carriers may have a maximum monthly benefit a dentist can quality for if he or she has multiple policies. Disability benefits are generally capped at a maximum total benefit amount, regardless of whether a dentist enrolls in one plan or many plans.

FILING FOR DISABILITY AND RELATED ISSUES

Disability insurance will begin paying benefits after a waiting period, which is generally 30, 60 or 90 days from the date of accident or illness. Premiums tend to be waived after a dentist begins collecting benefits.

“The sooner you identify a disability, the sooner you can file. A lot depends on the severity of the injury. But it is common for people to be in denial. It is not set in stone, but you often need to file within 90 days. You usually can’t start collecting until 30 days after you file,” said Marsh.

Engar recommends dentists keep a liquid emergency fund that can cover several months of expenses before disability benefits kick in.

Dentists may want to maintain licenses and certifications, as it can be hard to reinstate them if they lapse. But they also need an emergency plan for their dental practice, preferably in writing. Optional overhead insurance is typically paid out for only one year if a dentist is disabled. Perhaps the affected dentist’s peers can fill in for a few months while the practice is readied for sale, if necessary.

Disabled dentists who wish to pursue new careers may find satisfaction in teledentistry, dental practice consulting, dental claims processing, law, real estate or other fields. These alternatives may involve retraining or additional schooling.

“There are so many jobs out there related to healthcare where you can feel appreciated. Maybe you have leukemia, are breathing badly or have back pain and cannot make a living in clinical dentistry anymore. You can generally collect disability while working in another career. That is the norm now, but be sure that when you read the policy, you understand it,” said Marsh.

RESOURCES FOR DISABLED DENTISTS

Becoming disabled can necessitate financial adjustments for a dentist. “If you have to take disability payments, you are not going to get rich off of it. You will have to be more frugal,” said Engar.

Aside from financial concerns, dealing with a disability can be physically challenging and emotionally draining. “Take care of your injury first. Get proper medical care. You have to be able to survive. It was two years before I felt close to normal. Plan A is to get better,” said Marsh.

It can be difficult to come to terms with no longer being able to practice as a dentist in the career you trained for. Marsh’s left arm and leg were injured to the point where he couldn’t work. “Obviously, I couldn’t do dentistry anymore. But I could still be productive. I teach at a local dental hygiene school, am on the state dental board and am running AADD,” he said.

Marsh recommends reaching out to family, friends and fellow dentists for help. Churches may be good resources, as can support groups for cancer, cardiac issues and other ailments. Marsh says disability can bring anxiety and depression, so find supportive people and look to nature for peace and strength.

“If you are not going to get better, you have to have a Plan B and a Plan C,” Marsh said. “Take a deep breath. Look outside; the sun is shining. Start making some plans.”

Sarah Louise Klose is a freelance writer based in Chicago. To comment on this article, email impact@agd.org.

REFERENCES

1. Maleh, Johanna, and Tiffany Bosley. “Disability and Death Probability Tables for Insured Workers Born in 2000,” Social Security Administration, Actuarial Note, No. 2020. 6, June 2020.

2. Great-West Financial. “Disability Income Protection and Office Overhead Expense,” American Dental Association, insurance.ada.org/disability-insurance.aspx. Accessed 1 Aug. 2021.

3. “Health and Disability Benchmarking 2019, Long-Term Disability Program,” Integrated Benefits Institute, 2019, released 10 Sept. 2020.